Global shrimp production forecast of 5.6 million metric tons is slightly lower for this year

This article summarizes the annual Global Shrimp Aquaculture Production Survey and Forecast report from the Global Seafood Alliance, jointly prepared with Gorjan Nikolik of Rabobank and presented at the recent Responsible Seafood Summit 2023 held in Saint John, New Brunswick, Canada.

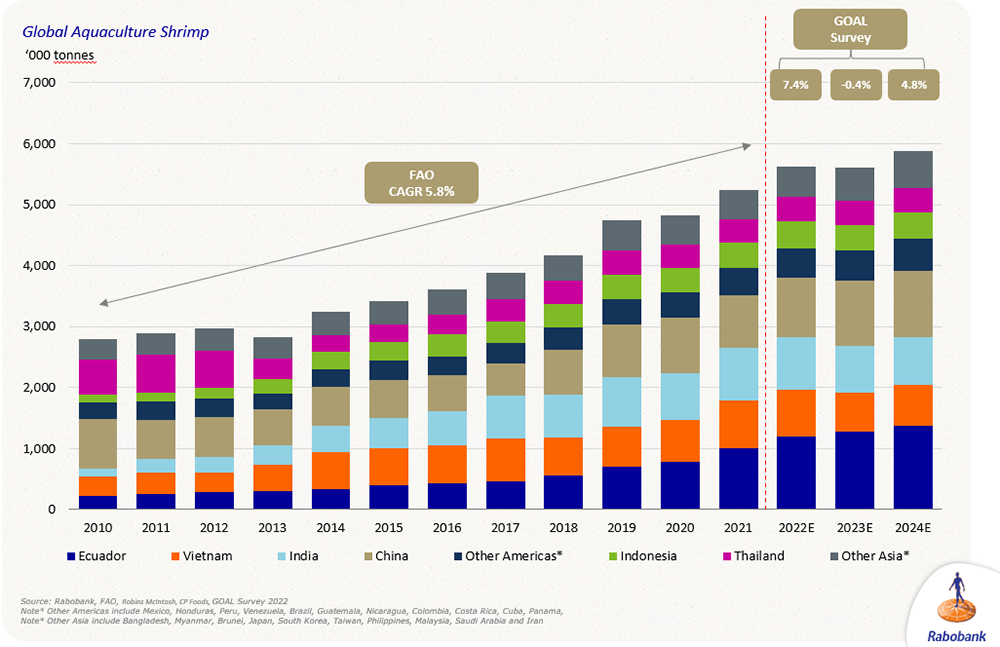

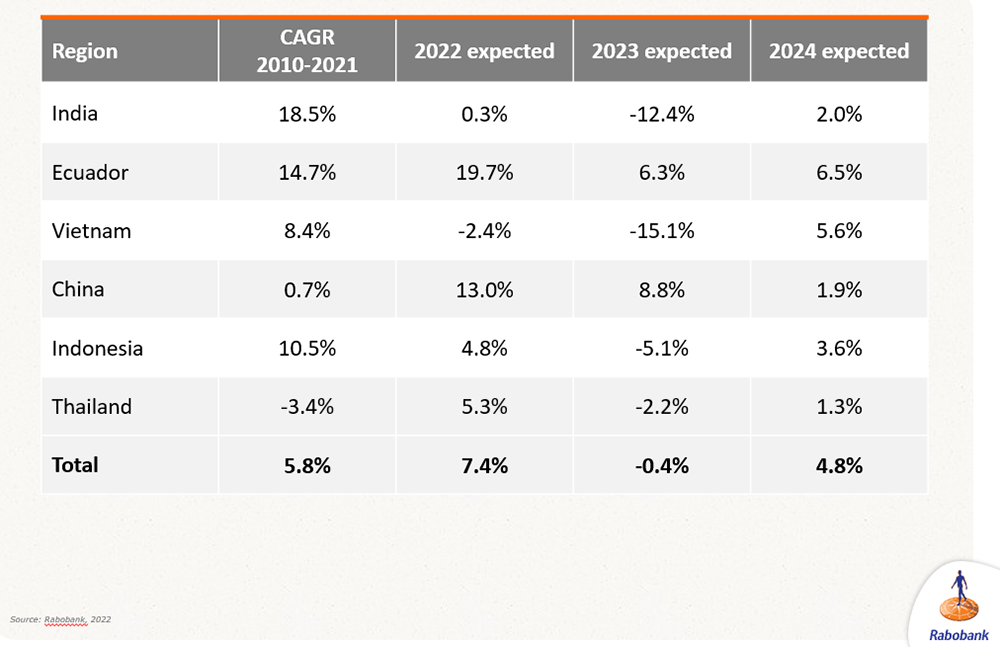

Survey results indicate that the world’s production of farmed shrimp in 2023 will likely be slightly lower (down 0.4 percent) at around 5.6 million metric tons (MMT) than in 2022, but that it is expected to grow by about 4.8 percent in 2024 to close to 5.88 MMT.

The top five producers in 2023 include, in order, Ecuador, China, India, Vietnam and Indonesia; these countries will account for about 74 percent of global production in 2023. Other important producers in Asia – including Thailand, Malaysia, Philippines, Myanmar and others – will contribute around 840,000 MT. And in Latin America, other producers led by Brazil, Mexico and Venezuela will add about 500,000 MT to world production in 2023.

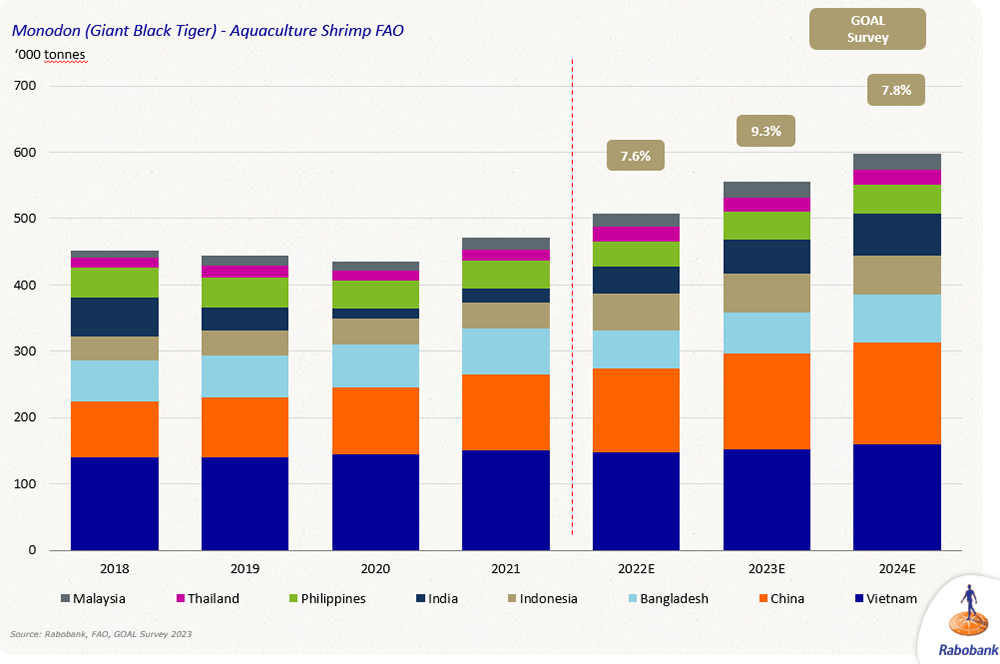

The Pacific white shrimp (Litopenaeus vannamei) continues to strongly dominate global production, while black tiger shrimp (Penaeus monodon) production keeps increasing and is contributing an estimated 550,000 MT in 2023 and projected to grow to close to 600,000 MT in 2024.

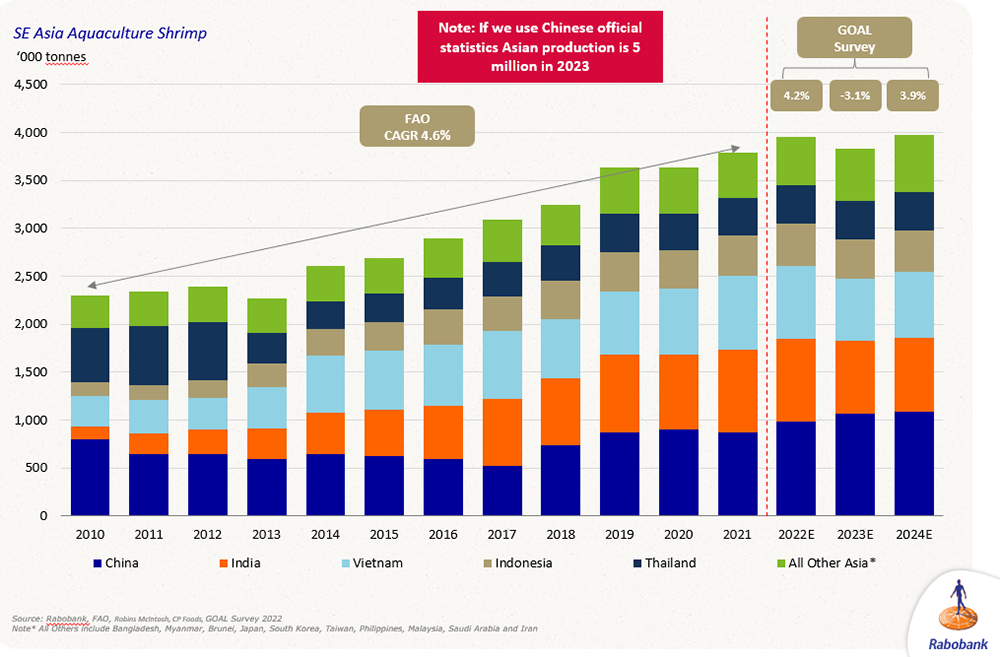

Asia

Shrimp production in Asia is projected to decline by slightly over 3 percent in 2023, the first annual decrease in a decade, but is projected to recover by close to 4 percent in 2024. These numbers are based on the lower of two estimates for China (about 1.06 MMT) in 2023; with the higher estimate for China (about 2 MMT per other sources), Asia’s total for 2023 could be close to 5 MMT. The industry in China is reportedly expanding rapidly with the use of greenhouses and RAS technology, which allow year-round production in many areas where open ponds traditionally produced only one crop annually.

India’s production of vannamei is contracting sharply in 2023 (possibly by 12 percent or so) but its monodon production appears to continue expanding, a sustained trend over recent years. Some recovery (about 2 percent) for its vannamei production is expected in 2024. Similarly, Vietnamese production of vannamei in 2023 is expected to contract by up to 15 percent in 2023, with an expected recovery next year of possibly over 5 percent. Indonesia will likely see a relatively lower contraction for vannamei of about 5 percent in 2023 and a projected recovery of over 3.5 percent in 2024. All these countries are top producers of not just vannamei but also monodon.

Black tiger shrimp continues its strong comeback across Asia, led by Vietnam, China, India and Indonesia. A decisive factor in this revival – considering that monodon was the top farmed species for many years and up to the early 2000s – is the relatively recent commercial availability of specific pathogen-free (SPF) vannamei lines and broodstock.

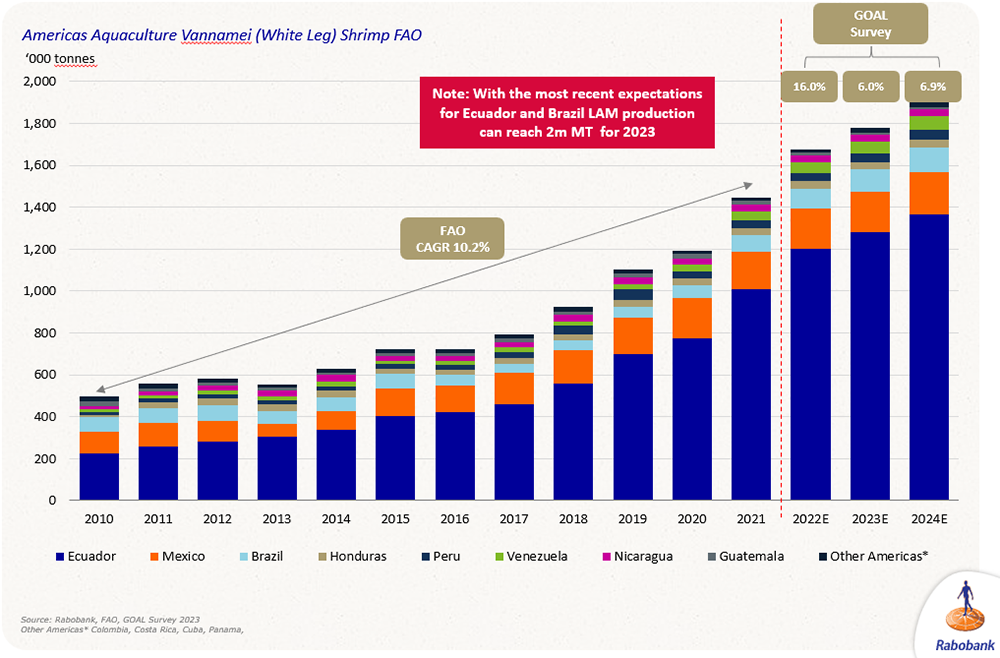

Latin America

Shrimp production in Latin America, the other major global producing region after Asia, is estimated to be at least 1.8 MMT, and could possibly reach 2 MMT in 2023, led by Ecuador, the top global producer during the last few years. Other major producers in the region include Brazil, Mexico, Venezuela, Peru, Honduras, Nicaragua and Guatemala. In general, despite production expansions in Ecuador, Brazil, Mexico and Venezuela, the growth rate of production in Latin America appears to be declining.

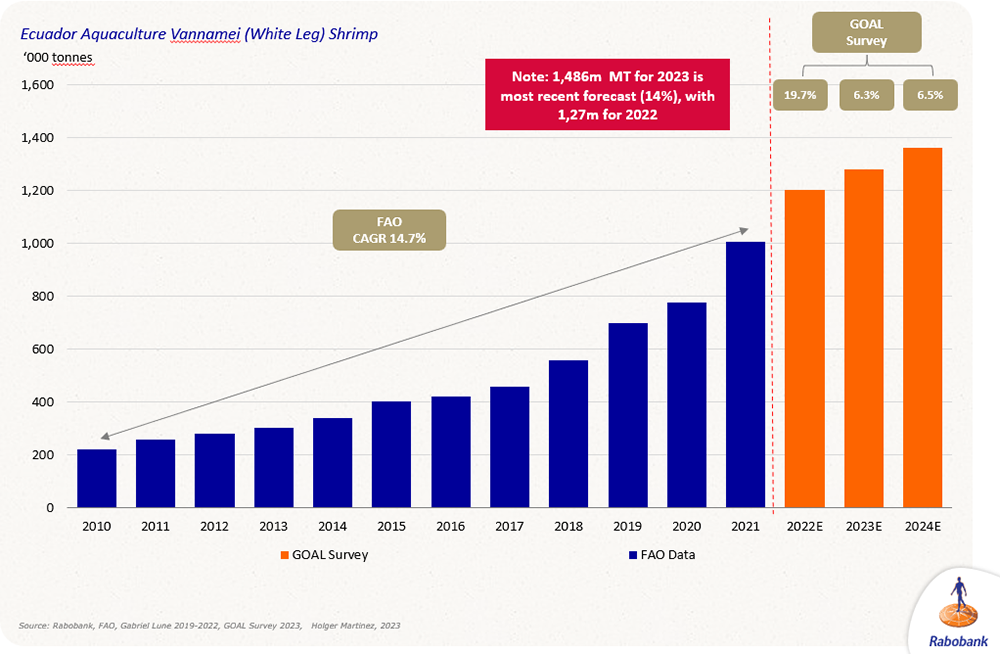

For Ecuador, some survey data appears to suggest a possibly slight slowdown in 2023, but the most recent data indicates that production in 2023 will be close to 1.49 MMT with continued growth projected for 2024. After a strong 16 percent growth in 2022, growth in 2023 and 2024 is projected to be around 14 percent p.a. based on the latest data, with 2024 production likely surpassing 1.5 MMT. The industry in Ecuador has benefitted very significantly from major investments in genetic improvement, farm technology – particularly automatic feeders and mechanical aeration – a strong industry association, the recent development of a huge export market in China, in addition to strong industry vertical consolidation among a dozen major companies. And Ecuador, along with India, reportedly have the industry’s lowest production costs.

Other regions

Various shrimp species are farmed in some form or other in several countries around the world, and sometimes involving some small volumes of minor aquaculture species like Pacific blue shrimp, banana prawn, Indian white shrimp and Kuruma shrimp; some of these species support major fisheries.

Notably among producers outside the two major producing regions are Saudi Arabia and Iran with vannamei productions of 60,000–70,000 MT each in 2023; and Australia and Madagascar with monodon productions of around 10,500 and 5,000 MT, respectively, in 2023.

Perspectives

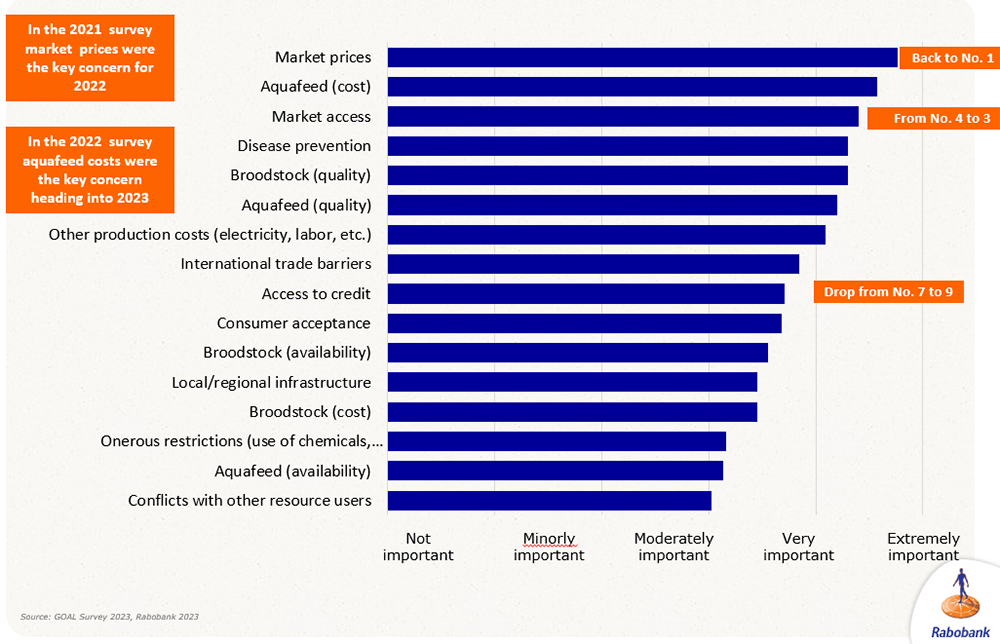

Based on survey responses, shrimp market prices are back to the number 1 concern in 2023; feed costs, market access, disease prevention and broodstock quality were the second to fifth top concerns. Market prices were also the top concern in the 2021 survey, while in the 2022 survey, feed cost was the main issue heading into 2023.

Overall, results of our 2023 survey of the global farmed shrimp industry indicate that after a strong 2022, the industry will see a modest supply decline of about -0.4 percent in 2023, and a more optimistic outlook for next year with an expected growth of 4.8 percent predicted for 2024.

There is significant potential to expand farmed shrimp production with the substantial gains achieved in recent years in genetic improvement, feeds and feeding and production technologies. However, as the global economy continues recovering from the pandemic impacts, shrimp markets must be able to absorb more production while equitably benefiting every component of the value chain.

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Darryl Jory, Ph.D.

Editor Emeritus

[103,114,111,46,100,111,111,102,97,101,115,108,97,98,111,108,103,64,121,114,111,106,46,108,121,114,114,97,100]

Related Posts

Intelligence

Can India sustain its farmed shrimp boom?

Long a global leader in farmed fish production, India has transitioned into an aquaculture powerhouse. Can its expanding shrimp sector keep the rapid pace?

Intelligence

Ecuador’s shrimp industry clearing numerous hurdles in 2020

It’s been a trying year for Ecuador’s shrimp industry, which is fighting low prices, supply issues to China – its top market – and the COVID-19 pandemic.

Intelligence

10 takeaways from GOAL 2019 in Chennai, India

The Global Aquaculture Alliance held its GOAL conference in Chennai, India, and recruited a host of experts in various fields to share their expertise.

Intelligence

At Aquaculture Roundtable Series, talk of change for Thai shrimp

The theme of the Aquaculture Roundtable Series in Chiang Mai was “Need For Change.” That means innovations in all production phases of Thai shrimp.

![Ad for [BSP]](https://www.globalseafood.org/wp-content/uploads/2025/07/BSP_B2B_2025_1050x125.jpg)