Farmed salmon and shrimp are ‘winning proteins’; U.S., China drive demand

The value of the global seafood trade reached new heights in 2021, and a new Rabobank report expects the “strong rebound” to endure through 2022, as the world continues to emerge from the Covid-19 pandemic.

Major markets like the U.S. and Europe have fully recovered, while China is gradually returning to pre-pandemic import levels. According to the report, premium aquaculture has been “the decade’s winner,” especially farmed salmon and shrimp.

Fish is one of the world’s most traded food commodities, with demand expected to increase another 15 percent in the next decade. The most traded animal protein, seafood has a trade value 3.6 times the size of beef, five times that of pork and eight times the size of the global poultry trade. In 2021, the value of the global seafood trade grew by $13 billion, reaching a new peak of more than $164 billion.

The report also revealed that the United States and China are driving demand. The United States is the fastest-growing market for seafood imports, with demand driven by health- and sustainability-conscious consumers, particularly among millennials and baby boomers.

“Seafood trade in the U.S. recovered more than expected in 2021 due to a combination of sustained at-home consumption and strong foodservice recovery,” said Novel Sharma, seafood analyst at Rabobank. “These factors led to peak imports for many species and an increase in import market share of high-value species. We expect long-term seafood demand to continue rising in the U.S.”

China is one of the most important seafood markets, with a growing middle-class interested in premium products. Wild catch and aquaculture production do not satisfy local demand, leaving China increasingly reliant on imports, especially for premium species like shrimp, crab, and salmon. The country’s latest plan for national fishery development aims to expand aquaculture production to meet domestic demand.

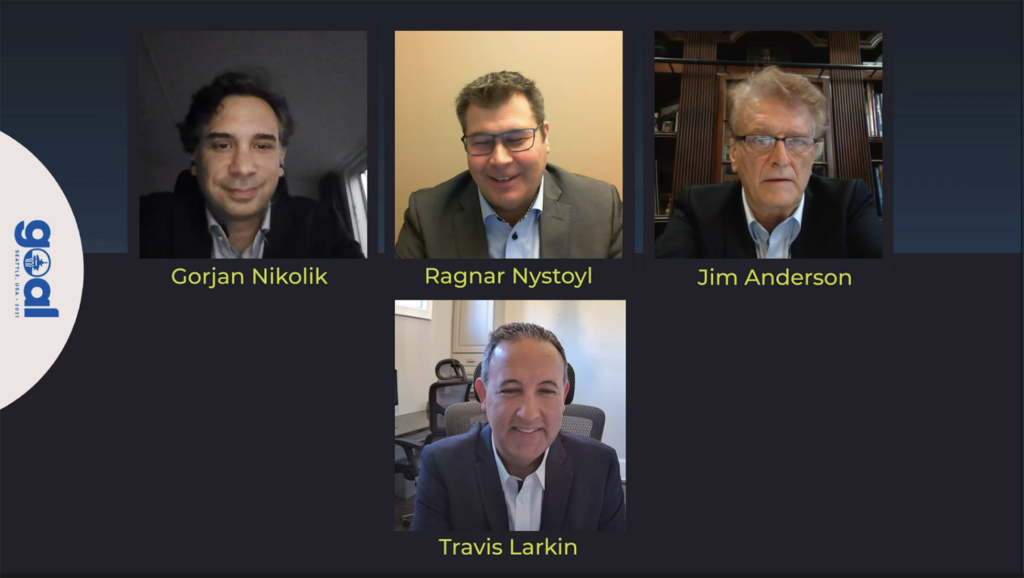

Back on stage: GOAL returns to tackle a wide range of seafood subjects

“In the short term, we do not expect a significant increase in volumes, and therefore we anticipate limited impact on trade flows,” said Sharma. Chinese imports took a hit during the pandemic and have not fully recovered to 2019 levels. “For now, Covid-19 restrictions will continue to impact the market. However, we expect these measures to be temporary, and imports should return to normal levels in the long term.”

Farmed salmon was one of the winning proteins of the decade, supported by growing demand for healthy and convenient protein, especially in Europe and the U.S.. Trade value dropped in 2020 but has rebounded with consumers continuing to cook more fish at home.

“Post-pandemic, the salmon trade’s value has been fueled by high prices due to increasing demand and restricted supply growth,” said Sharma. “Expansion of volumes will be essential for continued growth.”

Shrimp is the most traded seafood species, with short production cycles that allow exporters to respond quickly to demand changes. According to Rabobank, the shrimp trade is at an inflection point. Following record demand and supply in 2021, prices have been dropping since the second quarter of this year. Demand and prices have come down while costs (feed, freight, energy) are still high, impacting farmer profitability.

“This falling demand is likely to cause a short-term trade decline,” said Sharma. “Still, we do believe in shrimp industry growth. The industry is supported by strong, long-term demand, given shrimp’s position as a healthy and convenient seafood product with universal appeal.”

Click here to download the report.

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

Tagged With

Related Posts

Intelligence

Rabobank sees strong outlook for aquaculture amid Covid recovery

Pending the degree of a global Covid recovery, a leading food and agribusiness analyst at Rabobank says aquaculture is in a strong position.

Innovation & Investment

Aquaculture is winning, Rabobank analyst explains

Aquaculture is the “winning protein,” according to a new Rabobank report that its author, Gorjan Nikolik, said is intended to draw the bank’s agro-industry clients to opportunities in the fish farming business.

Responsibility

GOAL 2021: Growth ahead for the aquaculture industry

Discussion at the final GOAL 2021 event ranged from Ecuador’s booming shrimp sector to the ‘compass’ of the UN’s Sustainable Development Goals.

Responsibility

‘Aquaculture could feed the world,’ concludes International Labour Organization

An International Labour Organization technical meeting affirmed that aquaculture has enormous potential to feed the world, but there are challenges to harnessing its full power.