Spheric Research: Seafood industry must cater to younger consumers’ cravings for convenience and appealing options to thrive in the growing prepared foods retail market

Rotisserie chicken. Zesty and spicy pickles and relishes. At-home deli is the fastest growing sector within the U.S. food industry and it’s an area the seafood industry needs to muscle into fast.

Here’s the base argument. Deli retail food sales are big winners in the food industry this year, up 9.2 percent in July and August, according to Circana data, as penny-pinched consumers treated themselves at home instead of dining out. Prepared meats is the hottest item in the retail food sector, growing at double digits.

Dollar sales were down for seafood, albeit with per-pound increases for salmon and shrimp and ready-made seafood forms like cans and pouches. And therein lies the problem. Americans, especially younger ones, like healthy and lean protein. But they are often not getting the product in the format they want it.

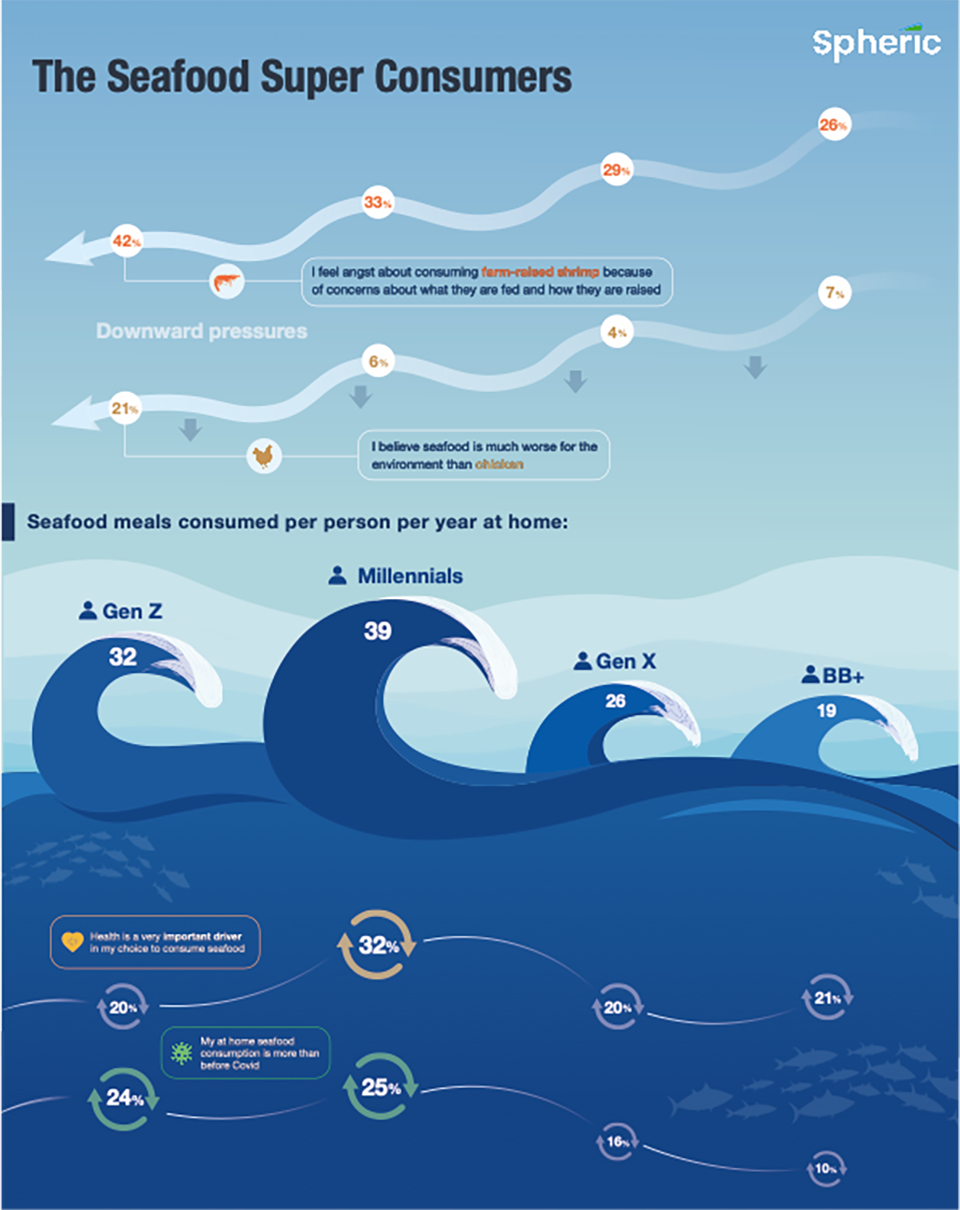

Spheric Research’s latest report, the U.S. Seafood Consumer Sentiment Report (CSR) published earlier this year, shows millennials and Gen Z have emerged from the pandemic as the most influential seafood consumers in the United States. Millennials consume seafood at home 39 times a year on average, versus 19 for Baby Boomers and older. Consumers aged 43 and under now represent more than half of the U.S. seafood market in pounds.

These younger consumers are interacting with seafood in a different way. They love sushi and they have brought the tinned seafood market back to life with trendy new designs. The viral TikTok trend of “tinned fish date night” has flummoxed seafood industry observers, especially as younger consumers increasingly prioritize the planet.

Millennials love recipes like Emily Mariko’s salmon bowl – who achieved TikTok stardom by flaking up an individual salmon filet, topping it with day-old rice, soy sauce, mayo, avocado and seafood. It can be made in less than 5 minutes, and most people who discover cooking salmon make it a habit because it’s quicker than cooking meat – and healthier.

One 31-year-old consumer we interviewed said she makes Mariko’s salmon bowls “all the time” as a healthy dinner, because it contains “clean ingredients,” that give her the “macronutrients” she craves.

Most seafood species, with the notable exception of salmon, are not being sold in portions and sizes and formats that attract younger consumers. Many exporters of premium whitefish to the U.S. market sell head-on, gutted fish, limiting their market access to the flat foodservice space.

Many older Americans enjoy a weekend cook-off or seafood boil, spending hours peeling shellfish, including favorites such as crab legs and lobster tails. Younger consumers, who are more sensitive to the treatment of animals, are repulsed by eyes, stalks, shells, tails and veins. They want healthy seafood protein, but they also want convenience and a product that is aesthetically pleasing. They are also not that into cooking.

So why should seafood producers focus on Millennials and Gen Z, and not on richer, older consumers? The answer lies in frequency. In ready-to-cook or ready-to-consume portions, younger consumers are willing to eat far more seafood than their elders.

Outside of neat individual skin-packed portions in salmon, and ready to cook seafood like breaded or battered filets, or fish cakes, older consumers are limiting consumption to special occasions. The weekend cookouts, 4th of July and twice-a-year big family gatherings.

In a survey of 1,000 consumers across the United States that are part of our CSR work, 48 percent said they purchased their last seafood item for a weekday meal, compared with 30 percent for a special occasion and 22 percent for a weekend meal. Ninety percent of respondents had made what they were eating before and only 15 percent used a recipe the first time. Critically, two-thirds of respondents said they seasoned or added spices to fish, with only one-third going into a more elaborate recipe involving sauces, stews, etc. That balance was 54-46 percent in the case of shrimp.

Seafood’s newfound retail popularity has a permanent feel to it

Analyzing shopfloor behavior in our survey, most consumers knew what they want and went straight to the fresh or frozen section of the store to pick it up. Consumers seldom compare the prices of fresh and frozen products, and they usually have chosen what they want to buy before they reach the store, meaning the marketing work needs to happen before the journey to the store takes place.

Given the above, it’s unsurprising that salmon is the main seafood item that is becoming a Tuesday or Wednesday evening meal in the United States, which is vital for increasing consumption frequency. Most other species, from white fish species to shrimp and crab, are getting bought by an older American demographic where there is limited upside to boost the frequency of at-home consumption.

Americans love seafood, and it sits on the right side of the equation when it comes to “flexitarianism,” or the trend of eating less meat to protect one’s health and the environment.

And the potential among younger consumers is staggering. When we made the CSR report, we called the younger consumers the “Seafood Super Consumers,” based on their frequency of consumption. But only arguably the salmon industry has enjoyed some success at making seafood convenient, by investing in value-added capacity to create more SKUs.

Producers of other species, what’s your excuse?

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Authors

-

-

George Crocker

Partner

Spheric Consumer

Tagged With

Related Posts

Intelligence

GOAL 2020: Seafood is on consumers’ plate and high on retailers’ agendas

With the retail and foodservice sectors working collaboratively, the seafood industry plugged crucial protein supply gaps and grew demand for fish.

Intelligence

Special report: Retail demand reduces COVID-19 pain for seafood industry

A poll of retailers commissioned by the Global Aquaculture Alliance (GAA) finds a brighter future for the seafood industry in the wake of COVID-19.

Intelligence

Responsible Seafood Summit 2023 blog – the Advocate reports from Saint John

Editors James Wright and Lisa Jackson are in Saint John reporting from the Global Seafood Alliance's Responsible Seafood Summit.

Responsibility

‘They thought we were crazy’: Behind one Faroe Island salmon farmer’s bold stance to reduce its carbon emissions

Hiddenfjord executive’s insistence that “fish should never fly” flies in the face of industry norm. This Faroe Island salmon company intends to do things greener.