Producer channels Tesla tactics in introducing land-farmed fish to market

Aquaculture in Europe has long been described as a stagnant sector. With a total production of just 1.3 million metric tons (MT), fish farming continues to be stymied by lengthy licensing procedures, considerable regulatory red tape, and weighty environmental and NIMBY (not in my back yard) opposition. It also has to contend with intense competition for precious water access from a growing number of players from far richer industries.

Against such a backdrop, the Food and Agriculture Organization of the United Nations (FAO) forecast that the bloc’s annual harvest will still linger below 1.7 million MT come 2030 is not a surprising one. And yet the aquaculture landscape is changing. New technologies are inspiring production shifts concerning a variety of important species like salmon, yellowtail kingfish and even flat fishes. And somewhere near the front of this charge is the recirculation aquaculture system (RAS) movement, with its influence extending into many different areas. What degree of impact it will have on European production remains to be seen, but the general vibe is positive.

Ole-Kristian Hess-Erga, co-founder Norwegian halibut producer Sogn Aqua/GLITNE, and also a prominent RAS researcher as the company’s development and quality manager, sees a lot of potential in recirculation aquaculture. He believes it can be adapted to most aquaculture species and a range of different regions, although he also highlights that from a cost perspective, RAS requires almost the same inlet water quality as re-use or flow-through systems, to avoid excessive investments in pre-treatments and electricity.

“Such issues would limit the application of RAS in some regions, but on the other side, [it could] open up areas with strict limitation on effluents,” he told the Advocate.

Meanwhile, salmon RAS, such as the new systems emerging in Norway and sprouting up across North America, are expensive – both to build and to run – and also require highly skilled operators and a high level of automation, he said: “Such advanced RAS might be limited to well-known and high-priced species, at certain stages or full-cycle close to the market.”

https://www.aquaculturealliance.org/advocate/ras-in-the-usa-fad-or-future/

Raising local supply

Kingfish Zeeland is one company that’s ticking these particular boxes. Established in the Netherlands in 2015 by Ohad Maiman (CEO), Kees Kloet (COO) and Hans den Bieman (chairman), its goal is to become a leader in high-value RAS farming, starting with the species yellowtail kingfish (Seriola lalandi). It is currently producing around 600 MT annually, and working on ramping up output to 1,000 MT. The fish is being sold across the EU, with some “strategically allocated volumes” going to the U.S. market.

“Europe is highly import-dependent in seafood, and with traditional aquaculture facing challenges to expand output, RAS is a natural and sustainable way to increase local production that would benefit both the fresh and sustainable availability, but also contribute to overall food security ability of Europe to further supply its demand,” said Maiman.

This business case is a strong one. With its population of around 500 million now consuming an average of 24 kg of products each per year, the EU is by far the world’s largest seafood market. In contrast, its 28 member states are collectively ranked a much more modest fifth place in terms of fish production. And this position would be much lower if it wasn’t for the 5 million MT coming from wild-capture fisheries. To meet the market’s growing demand for seafood, importsmake up more than 60 percent of the bloc’s supply and account for more than 70 percent of its consumption.

Incorporating a RAS design developed by Kloet and running completely on renewable energy, Kingfish Zeeland’s main facility was completed in 2017. Last year, it fulfilled its “three key milestones” of reaching the designed level of biomass (densities and standing stock); closing the hatchery cycle so that it’s fully reliant on the in-house broodstock, egg and fingerling supply; and sold all of its current capacity.

In getting to this stage, Maiman conceded that some hurdles had to be overcome.

“While the yellowtail kingfish is a robust species and well suited for RAS, it is also a very demanding species as far as its living conditions. We had to invest far above the average cost in our RAS system to assure high-spec optimal conditions, and maintain a 24/7 on-site production manager shift for fast reaction and troubleshooting,” he added.

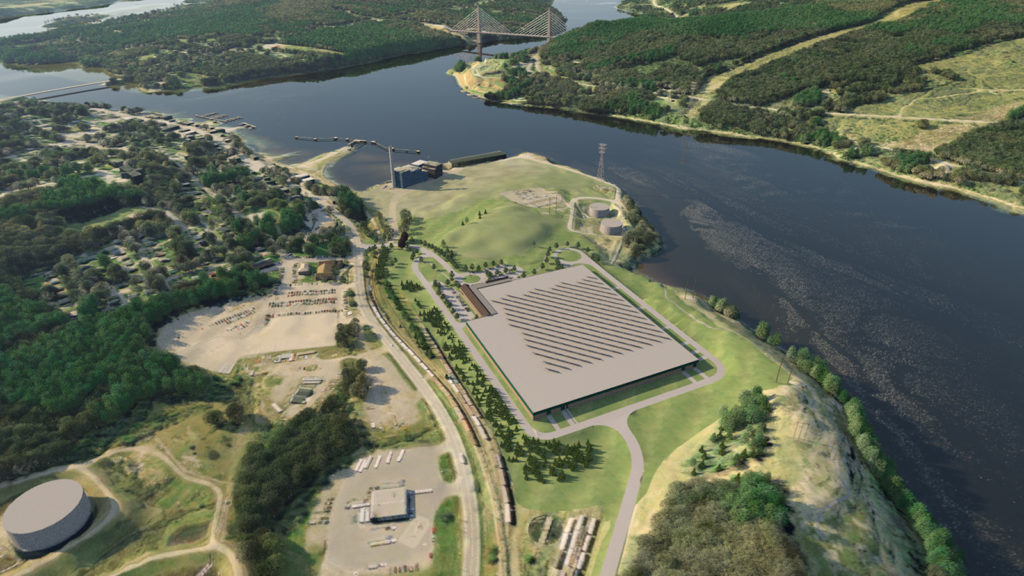

Nevertheless, having achieved its 2018 targets, Kingfish Zeeland has now turned its attention to expansion, and is working with Pareto Securities to secure a pre-IPO private placement investment round. As well as expanding in the Netherlands, this will help establish a U.S. operation. The plan is for 5,000-MT facilities in both locations within 12 to 18 months.

Lessons from Tesla

Maiman explained that the company chose to produce yellowtail because of the species’ “excellent performance” in RAS as well as its “premium-tier price point.”

The high value was critical when operating a high CAPEX and OPEX RAS operation, he said.

“For the long run, we have borrowed a page out of the Tesla playbook in the sense that yellowtail is our roadster – a high-value fish that allows us to operate at this stage,” he said. “The analog Model 3 would be the day we feel comfortable from an operational and financial perspective to go into more mid-market species.”

In the meantime, Kingfish Zeeland has found that there are several strong markets for its fish; ranging from traditional sushi and sashimi use, to Italian cuisine where it’s hooking consumers as a cooked, center-plate fish, and up to a “whole new market” of high-end western cuisine and premium retail.

As each market has different size preferences, the fish’s growth cycle ranges from six to 12 months.

“In the sushi/sashimi marketplace the kingfish needs no introduction – it is already known as a premium species, and our clients have been remarkably receptive to the ultra-freshness of our harvest compared to imports,” said Maiman. “The ‘fine dining’ western market required some product introduction, but once the quality of the product and the sustainable farming has been explained we find it that we are often a replacement to tuna.”

Lower-end options

Despite the current leaning towards high-value and niche or local species, given time, there may also be opportunities for European RAS at the other end of the product spectrum – by using basic water treatment and/or re-use systems. While Israeli company BioFishency is focusing most of its attention on bringing affordable systems to developing markets and isn’t yet involved in European aquaculture, its co-CEO and co-founder Igal Magen recognizes that the region is looking to produce more of its own fish.

“It’s importing more and more low-value, tropical species, while its own production is based on higher-value coldwater species like salmon and char,” he said.

Magen explained that this situation isn’t unique to the European region. “The aquaculture sector is growing but the demand for fish is always growing (more). Basically, we are not keeping up with demand. If you look at the FAO’s forecast to 2030, there will be an increase in aquaculture and somebody has to do that – meet the demand with supply.

“Norway, for example, wants to increase its production but without increasing the use of water. This means it has to go to RAS. It’s a very straightforward answer – if you want to grow more and you are limiting the amount of water that can be used then you have to go to RAS,” he said.

For the long run, we have borrowed a page out of the Tesla playbook in the sense that yellowtail is our roadster – a high-value fish that allows us to operate at this stage.

“We have been working for many years around the world, and no matter where you are – whether it’s a developing country or a developed country – the water problems are the same: Either you have issues with lack of water, or if the water is available, it cannot actually be used for fish farming because of the competition for water. And in some countries, there are strict regulations regarding the discharging of water. No matter how you look at it, water is becoming more and more of an issue.”

Although BioFishency’s “plug-and-play” filter systems are tailored toward upgrading converting flow-through systems to RAS in markets like China, India and Africa, Magen acknowledges that the affordability of such systems (with his company’s biofilters running between U.S. $10,000 and $20,000 depending on the product and volume of feed used) should make them a consideration for small-to-medium scale producers everywhere.

Not surprisingly, the company is looking to develop a filter that would work with some coldwater species, while its lowest price off-the-shelf “Mini RAS” fish farm is available for $80,000.

“You need to understand the market to be able to offer the solution. We believe that no matter what type of fish you are growing, RAS has a role to play. In some cases, it’s just hatcheries or nurseries, and for others it’s for full grow-out as a complete solution. But we believe that it will touch every sector of the aquaculture industry,” said Magen.

Education process

While it’s the key production stages of species like salmonids, along with local and/or niche species like Dutch yellowtail that offer the most immediate growth potential for European RAS, the consensus is that it will expand to include more full-cycle production systems.

Hess-Erga also believes that Europe’s other aquaculture sectors could learn plenty from both salmon’s use of RAS and from its application with lower-value species in developing regions, saying this is especially the case when it comes to the system design, production planning and the education of farm staff.

As for whether RAS can provide the spark that will get European aquaculture production moving in the right direction again, and in doing so, make Europe a little less import-dependent, he maintains that a lot also rests on increasing the public and consumer understanding of aquaculture, and at the same time increasing the actual producers’ knowledge of efficient large-scale production and how RAS fits into that picture.

Magen agrees.

“The main struggle is educating and bringing new technology into new markets,” he said. “It’s the same with farmers all over the world; they have what they have done for the past 20, 30 or 40 years and then you come in with new advice – you have to prove it to them. So while the technology is there, market acceptance is a challenge. This reluctance will change, but this is the stage that we now find ourselves at.”

Follow the Advocate on Twitter @GAA_Advocate

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Jason Holland

Jason Holland is a London-based writer for the international seafood, aquaculture and fisheries sectors. Jason has accrued more than 25 years’ experience as a B2B journalist, editor and communications consultant – a career that has taken him all over the world. He believes he found his true professional calling in 2004 when he started documenting the many facets of the international seafood industry, and particularly those enterprises and individuals bringing change to it.

Tagged With

Related Posts

Intelligence

RAS in the USA: Fad or future?

A rash of large-scale, land-based recirculating aquaculture systems (RAS) are planting their flags on U.S. soil, even though it will take several years and hundreds of millions of dollars of investment before they produce their first sellable fish.

Innovation & Investment

What to do with empty big box stores? Turn them into fish farms

The Innovative Aquaculture Alliance aims to install fish farms in empty big-box retail stores and other abandoned real estate across the United States.

Innovation & Investment

Competitiveness comes at scale for RAS operations

Total RAS salmon production worldwide is less than half of 1 percent of total production. Many of the investors flocking to the sector now are new to fish farming, and confident in its potential.

Intelligence

Location matters most for newest Maine RAS venture

A leader at one of the new Maine RAS ventures talks ambitions for his group and the growing land-based aquaculture industry, with his home state at the epicenter of North American operations.