Improved marketing, production chain may bring sector back

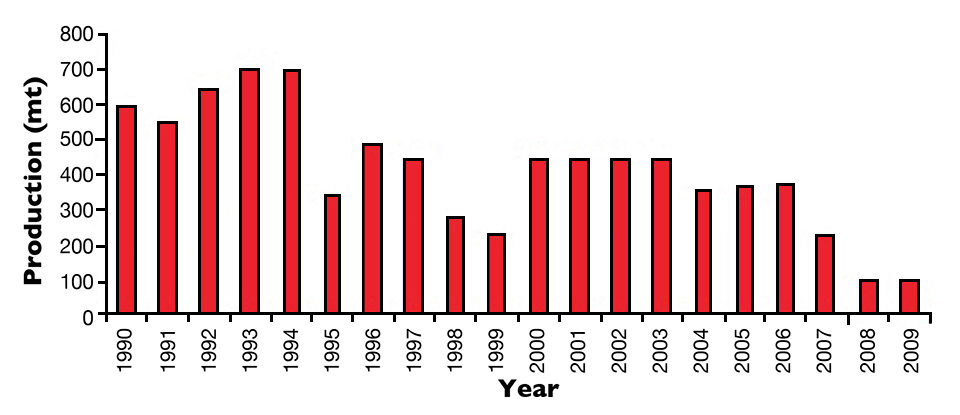

The farming of giant Malaysian prawns, Macrobrachium rosenbergii, in Brazil began in the early 1980s and attained an annual production of about 700 mt at the beginning of the 1990s (Figure 1). However, production decreased in 1995 for several reasons, including problems with marketing strategies, the rise of marine shrimp farming and expansion in the farming of fish species such as tilapia. A second fall occurred in 1998-1999 due to the closing of the largest freshwater prawn farm, which produced about 20 mt monthly with 50 ha of ponds.

According to United Nations Food and Agriculture Organization data, an annual production of 450 mt was reached in the first half of the past decade, but problems in postlarvae supply reduced production in 2007, 2008 and 2009. These problems occurred due to the closure of the largest hatchery of the Espírito Santo in 2008 and the temporary stoppage of another important hatchery in São Paulo in 2009.

With the 2011 start–up of a new hatchery in Espírito Santo, production is expected to grow again.

Production status

At present, M. rosenbergii is the only species commercially farmed in Brazil. Climatic conditions are suitable for production all year, except in the southern region, where farming occurs only from October to April. The entire production is absorbed by the national market.

Official statistics are scarce, but unofficial 2009 data obtained from hatchery owners indicated that M. rosenbergii were produced in all Brazilian regions and in at least 15 states. Prawns are cultured semi-intensively, mainly in Espírito Santo State, where Cooperativa dos Aquicultores do Espírito Santo (CEAQ), the largest Brazilian cooperative of producers, is located.

Generally, prawn culture is a secondary farming activity, but some producers believe that prawns have more stable sale prices than the primary products of the farms and thus present higher profitability. Farms are small – 0.5 to 2.0 ha – but two farms located in the states of Minas Gerais and Rio de Janeiro have about 5 ha of ponds.

In 2010, eight commercial hatcheries were operating in the states of São Paulo, Rio de Janeiro, Espírito Santo, Pernambuco, Rio Grande do Norte and Rondonia. In Espírito Santo, there are two hatcheries, and another is under construction. Discontinuity in supply and poor organization of the production chain are major problems. Postlarvae prices are higher than those for marine shrimp, varying U.S. $20-50/1,000 shrimp (excluding transport).

Some farmers stock postlarvae in earthen pond nurseries at 100-200/m2 for 45 to 60 days before the growout phase. Grow-out ponds of 0.1- to 0.3-ha size typically receive juveniles or postlarvae stocked at densities of 8-10/m2. Prawns are grown 120 to 180 days, depending on the local temperature.

If nursery ponds are used, it is possible to perform two or three cycles yearly in northern states and one or two cycles in the southern states. Productivity is around 1.5-2.5 mt/ha/cycle. Prawns are harvested at 20- to 30-g mean weight. Survival rates vary from 50 to 80%.

Only a few farms produce prawns in polyculture with tilapia, but there is potential for expansion since the low profitability of fish culture in ponds causes hundreds of hectares of ponds to be unused or underutilized all over the country.

Processing

If prawns are sold fresh, they are maintained after harvest for one or two days maximum in isothermal boxes with ice until selling time. Poor processing is still a problem, since almost all producers freeze prawns in domestic freezers for delivery to customers or for sale at the farm gate, with consequent loss of quality.

Only three Brazilian farms and CEAQ are legally equipped for prawn processing. Frozen prawns are packed in plastic bags of 0.5 or 1 kg after removing their rostrums and chelae, but there is an increasing demand for whole prawns. Only frozen tails and frozen meat are eventually sold.

Prawn sales

In Espírito Santo, most producers sell their entire production to CEAQ, which provides equipment and technical support to harvest the prawns, as well as an air-conditioned truck to transport them. In São Paulo, a small agritourism farm that includes a hatchery, restaurant and retail outlet for frozen prawns, provides postlarvae, feed and technical support to partner producers and guarantees the purchase of their production.

Prawns are sold mainly to restaurants and hotels. Sales to individual consumers occur only at specific sale points or the farm gates. Currently, the sale of prawns in fish markets or supermarkets occurs only in Espírito Santo and Rio de Janeiro. In other states, prawns are all sold frozen in limited retail outlets, with the purchase of fresh prawns being done only at the farm gate.

Prawns are generally size classified as small (15 to 20 g), medium (25 to 35 g) and large (35 to 45 g). Prices vary U.S. $15-18/kg and differ by about $1 from one size class to another. There are market niches for all prawn sizes, including the very small 10-g prawns.

The demand for premium prawns larger than 50 g, at prices of U.S. $20-23/kg, has increased in recent years. Many restaurants, mainly those specializing in Oriental food, are also looking for large live prawns at prices up to $25/kg. Another interesting market niche is the sale of berried females at prices about 30 percent higher than normal prawns of the same weight. Some restaurants offer delicacies prepared with rice and prawns with orange eggs to give a special color and flavor to the dish.

Freshwater prawns in Brazil are generally consumed by the middle and upper-middle classes, because their prices are high when compared to other protein products such as beef or chicken. However, the purchasing power of lower classes has recently been increasing, and therefore demand is also rising.

Marketing strategies

The CEAQ and some large farms produce good publicity material such as banners and brochures that present the qualities of prawn meat – low fat, low cholesterol, delicate flavor and nice texture. They also teach the basics of preparation of prawns and provide common recipes. This strategy is even more effective when the information is included in all packages of the product.

Visual advertising contributes greatly to marketing prawns and promoting the names of the producers and farms. The placement of logos, photos and tags on trucks and vans used daily also contributes to the same purposes. Outdoor signs are becoming more commonly used to identify and show the way to farms, restaurants and retail outlets that offer prawns.

Agritourism is a good strategy to aggregate value for the farmed prawns. This is mainly possible on farms close to big towns or tourist routes. People of all ages visit the ponds, broodstock tanks and prawn aquariums, and enjoy cooked prawns. In Rio de Janeiro, a large farm located close to a highway recently opened a restaurant within the property. In São Paulo, a small agritourism farm with a hatchery also maintains a restaurant within the farm.

Besides gastronomy, other forms of agritourism include the promotion of events at the farms, such as guided tours of the ponds and nurseries, harvest simulations, and promotion of courses and talks on prawn cultivation, as well as recreational activities. In Espírito Santo, CEAQ recently started to promote the annual Gastronomic Meeting of Prawns, with about 400 participants. The meeting includes musical performances and servings of several prawn-based dishes in addition to sales of frozen prawns.

Freshwater prawn culture is recognized as a sustainable activity. Marketing strategies should disclose this characteristic, following the worldwide trend of consumers wishing to select products farmed in a sustainable way. Some interesting strategies for the future could address organic culture or communicate sustainable technologies such as production with minimal water exchange or in integrated systems.

Perspectives

Over time, freshwater prawn production in Brazil has seen some falls followed by recoveries. This suggests it is a resilient activity that continues to offer potential for expansion but also presents some chronic organizational problems in the productive chain.

The recent decline in production occurred due to specific problems with important hatcheries and not factors such as diseases, low profitability or low demand. Freshwater prawn farming in Brazil currently has a favorable outlook due to increasing demand, the emergence of new market niches and increases in product value, as well as the prospect of improved organization of the production chain as a whole. Governmental actions to stimulate production would be helpful in this process.

(Editor’s Note: This article was originally published in the July/August 2013 print edition of the Global Aquaculture Advocate.)

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Authors

-

Helcio Luis de Almeida Marques

Scientific Researcher, Fisheries Institute

Agência Paulista de Tecnologia dos Agronegócios

São Paulo State, Brazil -

Marcello Villar Boock

Scientific Researcher, APTA Regional

Agência Paulista de Tecnologia dos Agronegócios -

Patrícia Moraes-Valenti

University of Santo Amaro

São Paulo, S.P., Brazil

Tagged With

Related Posts

Intelligence

Culture of giant freshwater prawns in China

Farming of giant freshwater prawns is very popular in China. The Yangtze River Delta region produces more than 60 percent of the country's output. Production increases have resulted from a novel system that involves greenhouses that allow ponds to be stocked ahead by two months.

Health & Welfare

Market test: Farm-grown freshwater prawns

A small test market at a high-end grocery store near Washington, D.C., USA, showed that farm-grown freshwater prawns would sell to high-income consumers who had not previously tried the product.

Aquafeeds

Alternative feed ingredient universe to convene at F3 meeting

What started out as a simple yet ambitious contest to drive innovation in the aquafeed sector has evolved into a fully global competition – and collaboration – amongst ingredient suppliers and feed manufacturers.

Health & Welfare

Ammonia toxicity degrades animal health, growth

Ammonia nitrogen occurs in aquaculture systems as a waste product of protein metabolism by aquatic animals and degradation of organic matter, or in nitrogen fertilizers. Exposure can reduce growth and increase susceptibility to diseases in aquatic species.