Marine ingredients crucial for responsible aquafeeds

The unique nutritional properties of fishmeal and fish oil have caused a constant demand for these products throughout the history of aquaculture. Not only diets for carnivorous species, but also hatchery feeds for herbivorous species often contain fishmeal and fish oil. Most fish and crustaceans feed on zooplankton when young, resulting in high protein and essential fatty acid requirements that are most easily met by marine ingredients.

When intensive aquaculture started during the 1960s and 1970s, fishmeal and fish oil were used principally for land-animal feeds and in the margarine industry as hydrogenated fat. However, as the nutritional knowledge of poultry and swine developed and consumers’ desire to have vegetable margarines grew, these two ingredients became more and more available for the growing aquaculture industry.

Over time, these trends have continued, and at present, aquaculture uses around 60 percent of the world’s fishmeal and 80 percent of its fish oil. This trend and the increase in price of both ingredients have led many to the conclusion that the growth of aquaculture will be limited by a shortage of these two important ingredients, or the seas will be plundered in a desperate attempt to meet the growing demand.

One could have argued back in 1960, when some 99 percent of the 3 million metric tons (MT) of annual fishmeal production went into swine and poultry production, that the future growth of these industries would be severely hampered by a shortage of fishmeal. This of course did not happen, and production of these animals is now around 10 times higher, while world fishmeal production has risen to 5 million MT.

If the growth of land animal farming was not restricted and consequent fishing remained controllable, will aquaculture be different?

Aquaculture: multiple industries

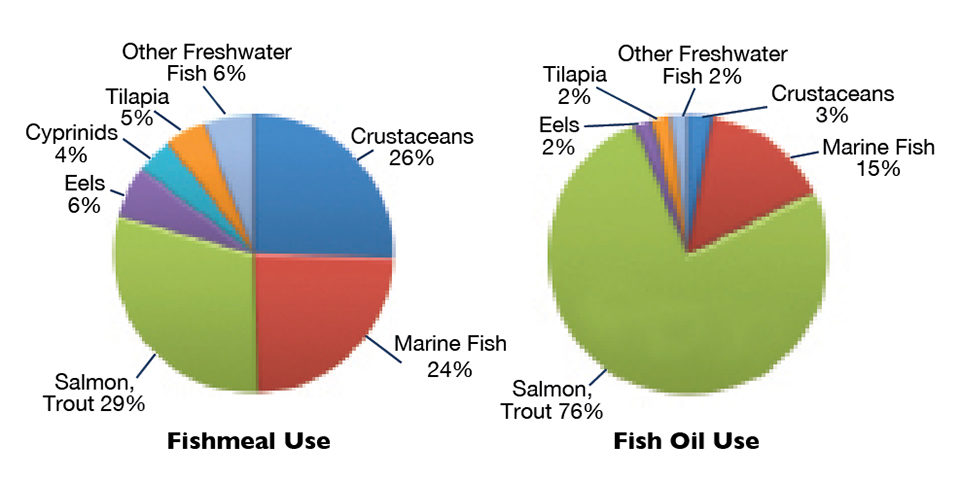

One thing to bear in mind is that aquaculture is not one species and one industry, as in swine farming. The wide variation of aquaculture species reflects where fishmeal and fish oil are currently being used (Fig. 1). Each sector is a separate industry with its own set of drivers based on factors such as nutritional requirements, feeding habits, environmental constraints, locally available feed ingredients, market price and consumer preferences.

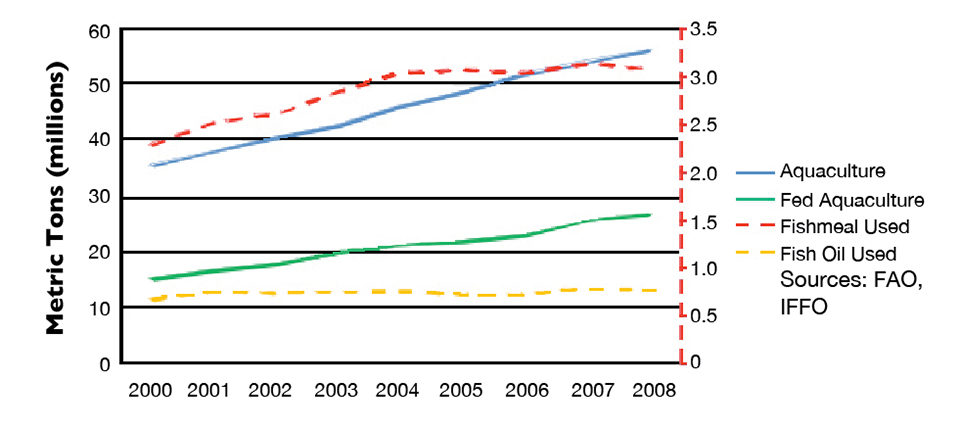

Demand for fishmeal and fish oil by the overall aquaculture industry has grown steadily for the last eight years (Fig. 2). During the same period, the amount of fishmeal used in aquaculture grew to about 3 million MT per year in 2004, but since has risen little. For fish oil, annual use in aquaculture stayed at 0.7 to 0.8 million MT for these eight years.

Alternative ingredients

This situation has been brought about through the steady replacement of fishmeal and fish oil with alternative ingredients. This was achieved by increasing nutritional knowledge of the major farmed species and improvements in raw material production and processing technology, particularly for plant ingredients.

Salmonid diets showed a steady decrease over the last eight years in both fishmeal and fish oil inclusion, while over the same time period, production went from 1.6 to 2.4 million MT per year, a 50 percent increase. The overall result is that the use of fishmeal in salmonid diets only went up from 0.78 to 0.92 million MT per year (18 percent), and fish oil rose from 0.53 to 0.58 million MT per year, a 9 percent increase.

The two critical factors that determine inclusion levels of a particular ingredient in a diet are nutritional value and price compared to other ingredients. The nutritional value is set by the requirements of the animal and the nutritional profile of the ingredient. The delivered price into the feed mill is set by market conditions that include world commodity prices.

As already seen with pigs and poultry, alternative cheaper ingredients have been found to replace fishmeal in most diets. The major difference between diets for agriculture and aquaculture is that protein requirements are higher in the latter, in part due to the poor use of carbohydrates by most aquatic animals. This high protein requirement reduces the number of suitable vegetable meals. The commonest fishmeal replacer in aquaculture diets is soymeal.

Aquaculture growth

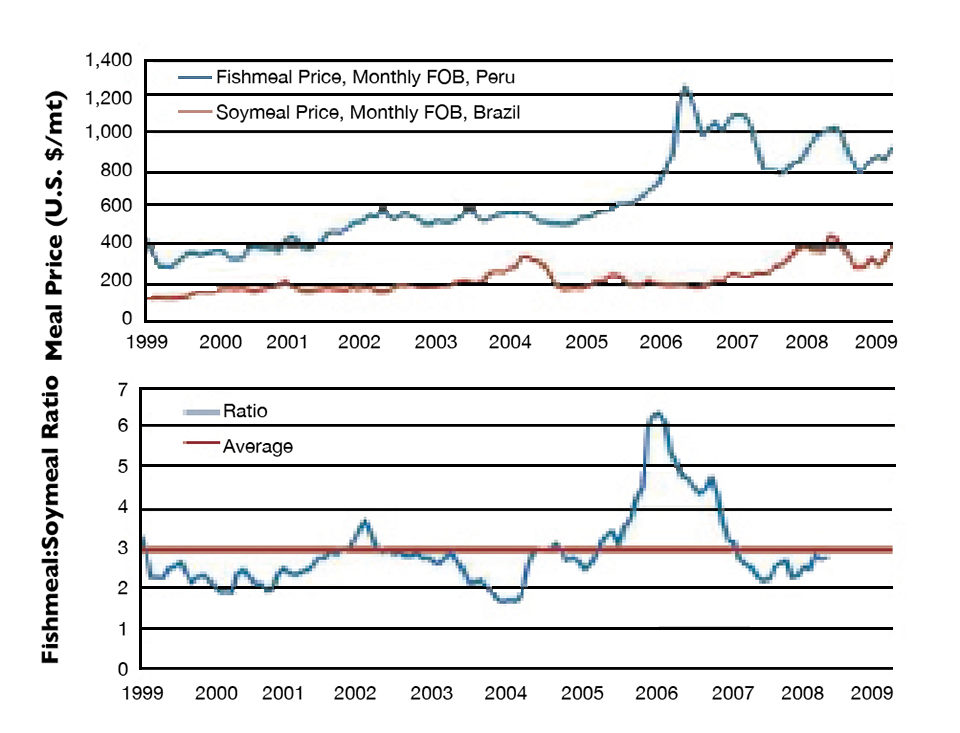

Too often in recent academic papers, the simple statement was made that the rising price of fishmeal will limit the growth of aquaculture. Fig. 3 shows that while fishmeal is more expensive than soymeal, the price of both ingredients has risen over the last 10 years. The second graph is more important, for it shows the ratio of the prices of the two ingredients. With fishmeal’s higher protein level and lack of anti-nutritional factors, it is normally around three times the price of soymeal. During 2006, the price of fishmeal rose steeply, and for a short time the ratio reached 6:1.

This price resulted in a global re-evaluation of inclusion levels. Prices then fell steeply at a time when the price of soy-meal was increasing. The result has been that the ratio has been below the historical level of 3:1 for the last 18 months. There is therefore no evidence that the price of fishmeal alone is limiting the growth of aquaculture. It may well be that the higher price of all feed ingredients in recent years is limiting the profitability of aquaculture and therefore slowing its growth.

Fish oil

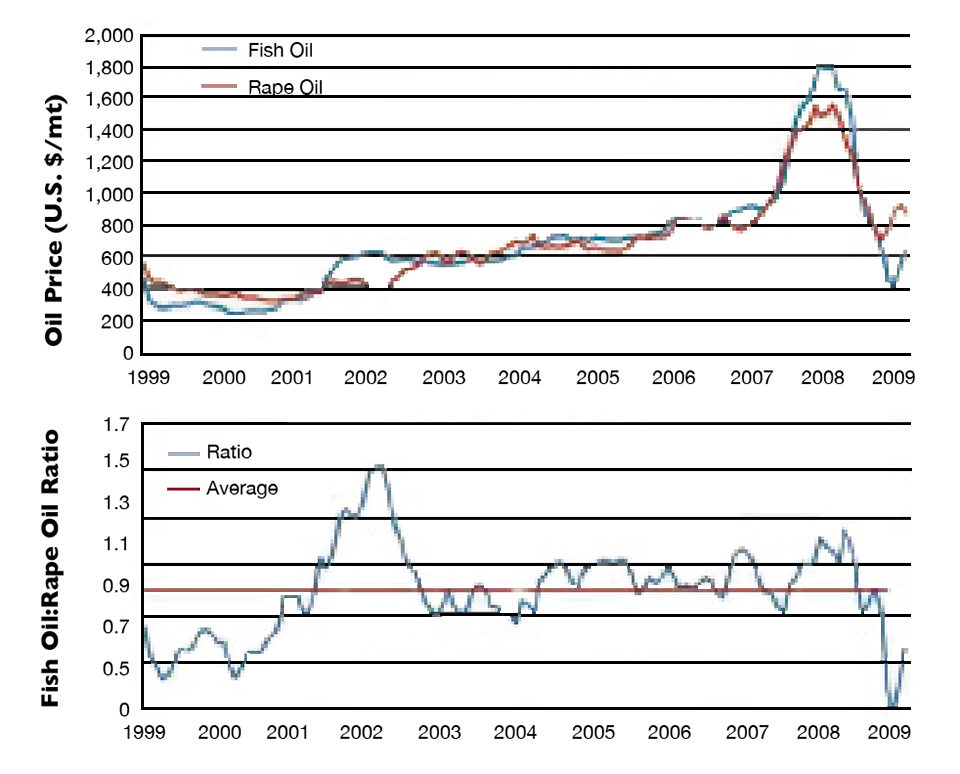

Because a bigger percentage of fish oil is used in aquaculture than fishmeal, many have said that instead of a “fishmeal trap,” there is in fact a “fish oil trap.” The most commonly used alternative to fish oil in aquaculture diets is rapeseed oil. The recent trends of the prices for these two oils and the ratios between them are shown in Fig. 4.

In 2002, fish oil was considerably more expensive than rapeseed oil, but rapid substitution resulted in its price falling below that for rapeseed for a considerable period. Again last year, the price of all oils rose steeply, and fish oil rose faster than rapeseed oil. This again resulted in fish oil replacement and prices that fell to a historic low of around half the price of rapeseed oil. There is certainly no evidence here of a fish oil shortage resulting in spiraling price increases.

Most fish, including salmon, do not have a high dietary requirement for the essential fatty acids contained in fish oil. Fish oil can therefore be easily replaced if the price gets too high. The performance of the fish is generally not impaired but, importantly, the levels of health-giving fatty acids in the finished farmed product are reduced. This reduction is important in markets where fish are seen as an excellent source of these critical nutrients, and medical opinion is agreed that the diets of the populations in many countries are deficient in them.

The evidence therefore demonstrates that, despite the fact that fishmeal and fish oil production is not increasing, their prices are remaining relatively stable against alternative ingredients. Also, for the last few years, the amount of fishmeal and fish oil used in aquaculture has remained static, while output from aquaculture has continued to increase.

Sustainable fisheries

The critical issue the fishmeal and fish oil industry faces is demonstrating that its commonest raw material, pelagic fish, is being caught in a sustainable way. Fishing can either be practiced like mining through extraction until the resource is exhausted, or like farming, where harvesting an amount that allows the recovery of the resource supports annual cropping indefinitely.

Pelagic fish are by nature short-lived, fast-growing fish that lend themselves to the “farming” method of fishing – and their continuing high catches over decades are proof of this. However, there have been cases of poor management and even a few cases of fish “mining.” It is therefore important for the industry to develop a means by which customers and stakeholders can reassure themselves that the fishmeal used in their aquaculture comes from responsibly managed fisheries.

Global scheme for responsible supply

The International Fishmeal and Fish Oil Organisation has been developing a Global Scheme for Responsible Supply with the aid of many stakeholders, including the Global Aquaculture Alliance. This program is a third party-audited set of standards that allows fishmeal and fish oil producers to demonstrate that their raw material comes from fisheries managed according to the United Nations Food and Agriculture Organization Code of Responsible Fishing; that no illegal, unreported or unregulated fish are processed and that factories have quality systems that confirm there is no contamination of the products.

The first applicants for this unique program are currently going through assessment. Early interest has been very encouraging from producers and the value chain alike. Systems like this can give the aquaculture value chain a means to demonstrate that its feed is responsibly produced and ensure that sufficient quantities of fishmeal and fish oil are available to allow the aquaculture industry to continue its growth in a sustainable way.

(Editor’s Note: This article was originally published in the January/February 2010 print edition of the Global Aquaculture Advocate.)

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Andrew Jackson, Ph.D.

Technical Director

International Fishmeal and Fish Oil Organisation

2 College Yard

Lower Dagnall Street

St. Albans, Hertfordshire,

United Kingdom AL3 4PA

Tagged With

Related Posts

Aquafeeds

A look at corn distillers dried grains with solubles

Corn distillers dried grains with solubles are an economical source of energy, protein and digestible phosphorus to reduce feed costs and fishmeal usage.

Aquafeeds

A look at protease enzymes in crustacean nutrition

Food digestion involves digestive enzymes to break down polymeric macromolecules and facilitate nutrient absorption. Enzyme supplementation in aquafeeds is a major alternative to improve feed quality and nutrient digestibility, gut health, compensate digestive enzymes when needed, and may also improve immune responses.

Aquafeeds

A new nutrient for aquaculture, from microbes that consume carbon waste

Biotechnology firm NovoNutrients aims to produce a line of nutraceutical aquafeed additives as well as a bulk feed ingredient that can supplement fishmeal. Its process includes feeding carbon dioxide from industrial gas to a “microbial consortium” starring hydrogen-oxidizing bacteria.

Aquafeeds

Algae alternative: Chlorella studied as protein source in tilapia feeds

Chlorella and other species have potential as protein sources in aquafeeds. In trials with tilapia fry raised in a recirculating system, the fish received a fishmeal-based control diet or feeds with portions of the fishmeal replaced by Chlorella.