Identifying, addressing current barriers to sustainable ocean financing

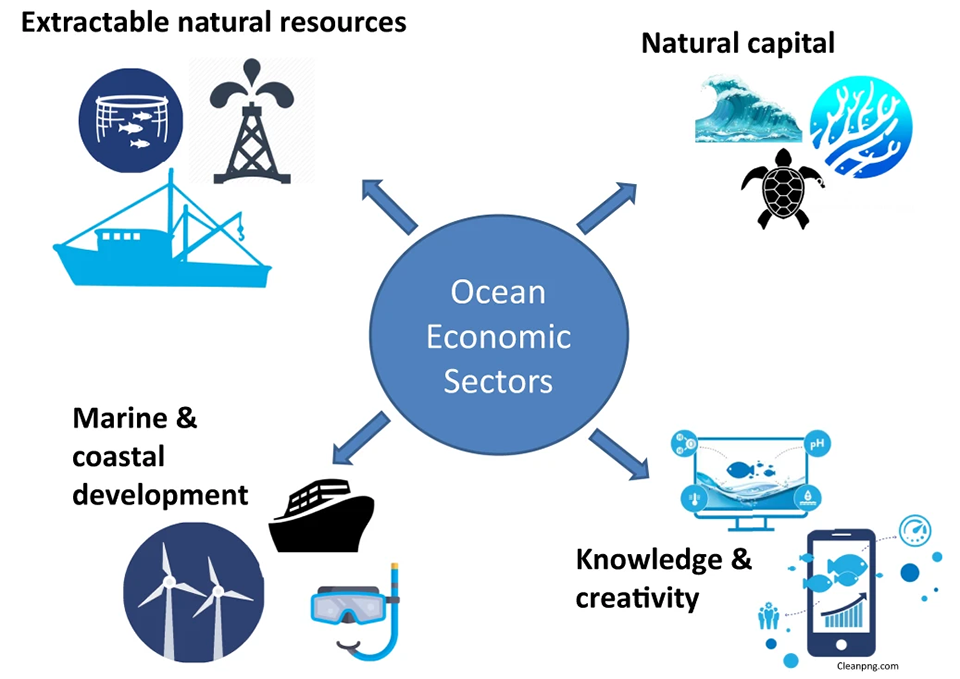

Oceans contain a diversity of renewable and non-renewable resources – like aquaculture, fisheries, oil, and gas deposits – that provide the intermediate inputs, such as waves and fish stocks, to support various ocean-based industries, including renewable energy and seafood production. The size of the global ocean economy, which includes fishing, shipping, offshore wind, maritime and coastal tourism, and marine biotechnology, was estimated at (U.S.) $1.5 trillion, or 2.5 percent of global gross value added in 2010. This value is growing rapidly, and prior to the COVID-19 pandemic, it was projected to increase to $3 trillion in 2030. This is likely an underestimate since many valuations do not include benefits that lack a market value, such as cultural, social and ceremonial values.

Another study conducted in 2015 estimated the annual gross marine product value to be at least $2.5 trillion per year, based on the value of the ocean’s total asset base consisting of the direct output of the ocean from marine fisheries and coastal ecosystems, marine trade and transport, and adjacent assets like tourism and carbon absorption. The ocean economic sectors (Fig.1) with the strongest growth potential include marine aquaculture, fish processing, offshore wind, and shipbuilding.

A vibrant ocean economy depends on sustainable and healthy oceans. However, many aspects of current ocean resource use patterns make it unsustainable, including human transformation of marine ecosystems, overfishing, destructive fishing practices, direct habitat damage, pollution and climate change, all major threats to the future sustainability of oceans and their resources. Clearly, existing use practices need to evolve to ensure that they are compatible with an ocean economy that is sustainable.

Ocean finance deals with the demand for, and supply of financial capital for investing in ocean-related economic activities and governance. For a sustainable ocean economy, ocean finance must be adequate and directed toward sustainable use and governance of the ocean and its resources. Key elements of financing a Sustainable Ocean Economy (SOE; the development of the ocean economy in a way that balances the needs of people, planet and prosperity) include generating, investing, aligning and accounting for financial capital. This encompasses local, national and international level financial instruments that are provided by, and/or accessed by individuals, public and private companies, governments and other non-governmental/inter-governmental institutions.

This article – adapted and summarized from the original publication [Sumaila, U.R. et al. 2021. Financing a sustainable ocean economy. Nat Commun 12, 3259 (2021)] – discusses barriers to finance a sustainable ocean economy, and how to address these barriers.

Barriers to financing a sustainable ocean economy

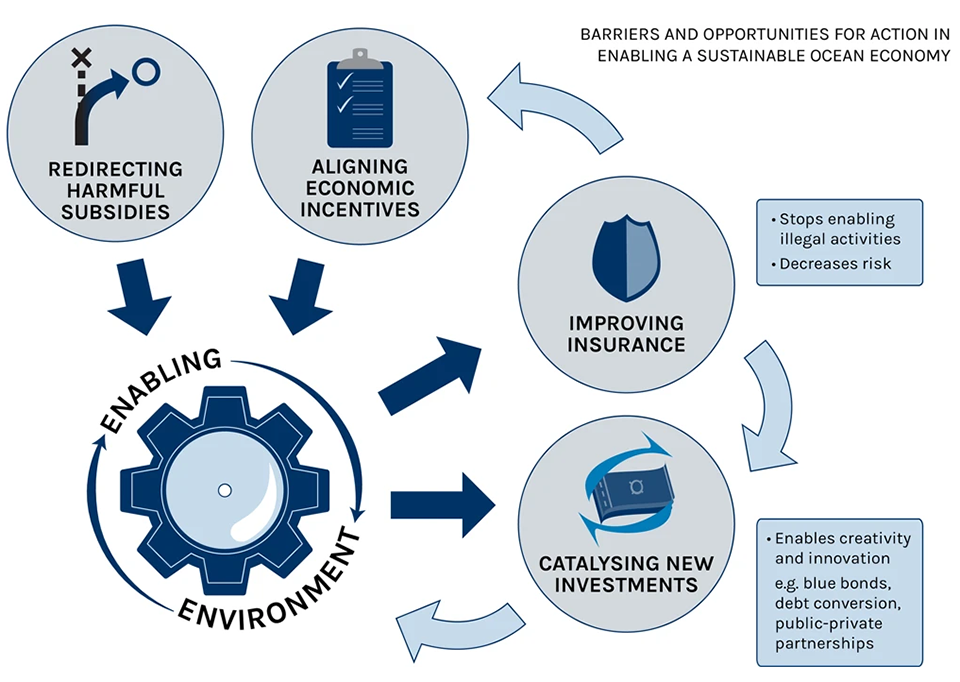

We discuss three key barriers that are currently preventing the flow of adequate ocean finance. The first one is the set of challenges we categorize under enabling environment, i.e., an environment conducive to attracting sustainable ocean finance. Public policies such as those pertaining to the provision of subsidies and how they help align incentives are crucial to creating such an enabling environment (Fig. 2). We further categorize two other barriers to financing an SOE as finance and investment, and insurance and risk mitigation.

Enabling environment

Effective and stable regulatory and policy environments to attract investment and funding are lacking. Current financing conditions are not attractive enough to encourage investors and financiers to invest sustainably in the ocean economy. In particular, current policies and regulations that strengthen the sustainable management of natural capital and that facilitate and incentivize social enterprise and new forms of capital are insufficient for attracting the needed quantity and quality investment to the ocean economy. Information and knowledge about the ocean and its economic, social and environmental value is missing or often inadequate.

For appropriate and adequate finance to flow into the ocean economy, its overall contribution to the ocean economy needs to be understood and measured more comprehensively than it currently is. Even in cases where ocean finance data are available, these are often too aggregated in existing national accounts.

Ocean economic activities that generate negative externalities such as fossil energy extraction, unsustainable fishing and non-green shipping receive subsidies. The International Monetary Fund estimates that 6.3 percent of global GDP ($4.7 trillion) was provided as fossil fuel subsidies in 2015 to both ocean and land-based businesses, and $35 billion in subsidies is allocated to global marine fisheries each year, of which $22 billion is allotted to harmful subsidies that lead to overcapacity and overfishing.

Beneficiaries and impactors of the ocean do not consistently nor adequately pay for access, use, or management of ocean resources. Maritime countries are generating large economic outputs from the ocean economy, but the cost of ocean management is currently not being borne by those exploiting it, including direct harvesters and consumers. Consequently, there is underfunding of ocean governance and the health that underlies the ocean’s economic outputs. The private sector also benefits from, and impacts upon the ocean, but generally does not contribute sufficiently to the management of the ocean economy.

https://www.aquaculturealliance.org/advocate/global-area-estimate-marine-aquaculture-development/

Finance and investment

There is a lack of high quality, investible projects with appropriate deal size and risk-return ratios to match available capital. While there is no shortage of investment capital available globally, the immediate lack of high quality, investible projects that would contribute to an SOE is a substantial challenge. Many ocean interventions require grant capital that generate very low, or no financial returns at all.

For the minority of projects that do benefit the ocean and generate a financial return, many are too small to be financially viable once the costs of due diligence are considered; and too high in risk-return profile due to the relatively more unpredictable conditions that ocean economic sectors operate under compared to those on land. Nevertheless, there are new innovative projects that have overcome these barriers. For instance, a European company that set up the first floating solar panels in the Maldives: It achieves a 3 to 8 percent rate of return from its investment by engaging in a long-term power purchasing agreement with its client, usually a hotel or utility company, and both parties benefit.

Access to ocean finance and resources is limited and not equitably distributed. Ocean resources are “rarely equitably distributed,” and many of their benefits are captured by a few. At the same time, a large proportion of the costs from ocean-based economic activities are borne by women, youth and marginalized communities. This inequity is exemplified by the provision of subsidies to the fossil fuel sector, wherein subsidies to big business only serve to increase inequality, which ultimately leads to unfair distribution of ocean economic values and benefits to small-scale actors.

Insurance and risk mitigation

Ocean investments often have high risks but the enabling regulatory environment for attracting investors is not in place. Overcoming the higher risk profile associated with the ocean sector will require addressing a number of challenging enabling conditions in order to attract investments and new forms of finance. These challenges include human capacity constraints, data challenges and higher risk of operation.

In addition, structural challenges related to the ocean make scale and replication more complex than in more familiar terrestrial sectors (notably related to tenure and ownership, monitoring, and enforcement). In order to attract large-scale investments, it is critical to find ways to de-risk the enabling environment associated with ocean-based sustainable development projects and activities.

While marine insurance is a strategy for managing commercial risks for shipping, aquaculture, fishing, and other offshore industrial activities, it does not cover all risks to the ocean economy (e.g., blue carbon and nature-based infrastructure investments). Further, smaller sized companies may not always purchase insurance, partly due to lack of affordability and availability, implying that other strategies besides insurance are needed for mitigating risk.

Addressing the barriers to financing

Actions that can be taken to address the challenge of financing an SOE:

Enabling environment

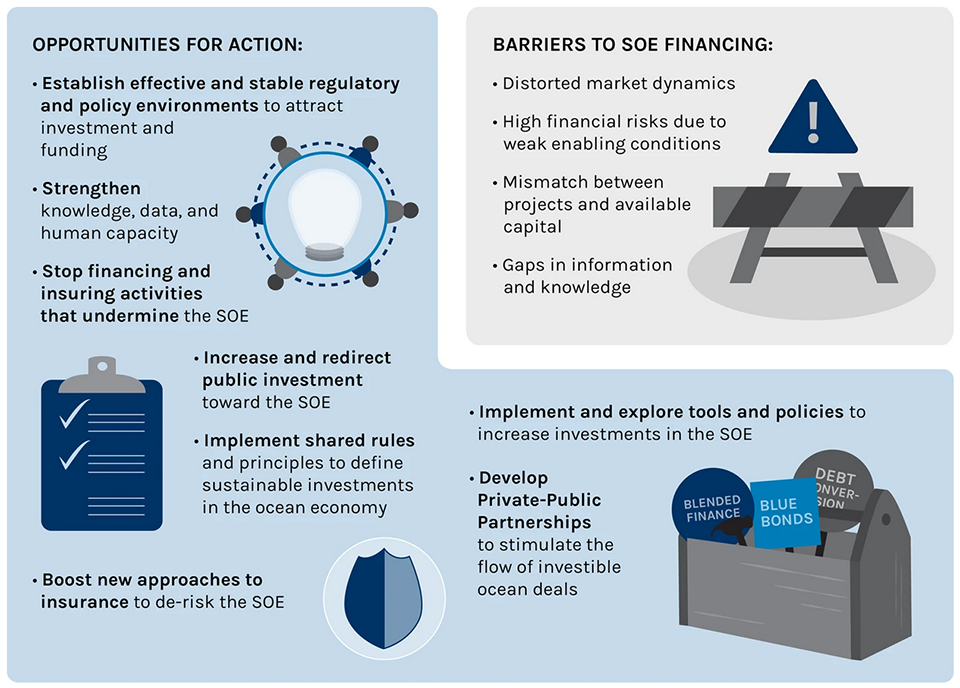

Establish effective and stable regulatory and policy environments to attract investment and funding. Governments and multilateral agencies can create attractive financing conditions (Fig. 3), which can be achieved by reforming policies and creating regulations that strengthen the sustainable management of natural capital and that facilitate and incentivize social enterprise and new forms of capital. This might include national policies that secure tenure and establish robust enforcement mechanisms in the fishing sector, or that support technology transfer and incentivize renewable energy. Governments should also create conditions that provide access to financing, savings, micro-insurance, and other services.

Market-based incentives, such as certification, can increase the investment potential for projects by providing some assurances on sustainability throughout the supply chain and implementing more transparent monitoring approaches. This is needed because the low traceability in many marine seafood supply chains impedes the capacity of corporate investors to steer investments towards more sustainable practices. Governments can create stronger incentives for certification, while the conservation and development sectors will need to provide technical assistance.

Strengthen national, regional and global data infrastructure to increase transparency, grow knowledge, and build effective human capital worldwide, particularly in developing countries. More consistent and comprehensive monitoring and reporting on finance for an SOE, especially financial flows for biodiversity across both the public and private sectors is needed.

Countries should, individually and regionally, invest in data and analysis. Government budgets need to be able to track spending on ocean-based sustainable development. Developing ocean data architecture at sufficient granularity will help private investors to get sufficient information to make key investment decisions and support good business plans and practices. To build the kind of information needed to attract investments into the ocean economy, we need to significantly increase the human capacity for acquiring, investing and aligning ocean finance in many developing maritime countries.

Allocate a greater proportion of ocean economic output into multi-sector ocean governance strategies. A resilient ocean economy requires rigorous and comprehensive ocean governance, and hence needs continuous funding. Diverting even a small amount of the ocean’s projected gross value added of $3 trillion in 2030 could raise substantial funds to strengthen ocean governance and put in place the necessary pre-requisites to attract investment into the sector. Countries could capture these revenues using a combination of domestic taxes, levies, fines, fees, and other mechanisms that monetize ocean benefits and ocean impacts, such as payments for ecosystem services. These mechanisms, in combination with proper management measures – which may include assigning access rights to indigenous coastal communities or limiting access to ocean resources – can generate revenues to help bring about an SOE.

Finance and investment

Introduce new financing mechanisms and tools. New financing tools and access to capital markets are needed to act as a positive incentive for sustainable, inclusive and climate resilient ocean activities. Innovative financial instruments (Fig. 3) can enable new entrants, including women, youth and marginalized communities, into the SOE while reducing the overexploitation of ocean resources. These tools can also facilitate effective management and governance while promoting the security of the ocean space in a context of increased access to new ocean resources. For instance, the IIX Sustainability Bonds are debt securities that can be listed on a social stock exchange; these bonds explicitly target the inclusion of women in economic activities.

Develop Private-Public Partnerships to stimulate the flow of investible ocean deals needed to overcome the initial short-term capital costs required for investments in projects, such as renewable ocean energy, ocean infrastructure, and rebuilding fish stocks. For developing countries, debt conversion or restructuring programs allow debt owed to creditors to be restructured and converted into agreed upon initiatives that address, for instance, marine conservation and climate change. The debtors are then obligated to execute the initiatives.

Financial institutions incorporate environmental and social sustainability into their risk assessment and investment frameworks. With their considerable clout, banks (e.g. multilateral and national development banks) can use mechanisms such as corporate debt and covenants68 to set and promote a sustainability agenda in all ocean sectors. For instance, initiatives such as the Principles for Investment in Sustainable Wild-Caught Fisheries and the Ocean Disclosure Project can be further developed and applied to other ocean economic sectors.

Pension funds, sovereign wealth funds, and large passive investors need to be partners in the effort to achieve an SOE. They can use their clout as significant investors in many extractive sectors. The “blockholding” power that this affords institutional investors gives them significant leverage to influence corporate policy on issues ranging from sustainability policies to corporate governance.

Insurance and risk mitigation

Boost new approaches to insurance. The insurance industry has the potential to play three important roles as risk managers, risk carriers, and investors. As risk managers, insurers can communicate recommendations for more sustainable practices by their clients and within the communities they serve. As risk carriers, insurers can choose to exclude or restrict access to insurance to clients or projects that engage in unsustainable or illegal practices. Finally, insurers are also major institutional investors, and in this role, they can elect to support only those clients or projects that contribute to an SOE and divest from those that do not.

There is also an opportunity for all levels of government – local, national or international – to work with the insurance industry to promote the development of an SOE. At the local level, this could involve making improvements in risk modelling, and at national or international levels, policy and regulatory frameworks could be reshaped to incentivize responsible and sustainable maritime industry practices.

Develop and deploy parametric insurance instruments (a type of insurance coverage that pays out an agreed upon sum based on the expected loss arising from a trigger event) in support of ocean health. By risk-adjusting these types of investments, it is possible to develop, replicate, and scale these types of examples around the world.

Perspectives

A healthy ocean that supports an SOE requires a range of interventions to improve governance, science, and management; finance is an important enabler of an SOE and underlies all ocean initiatives. The best ocean policies and practices can be undone by inadequate finance and by economic externalities that undermine conservation and sustainable use. Here we summarized the current status and challenges in financing an SOE, and to outline actions to overcome the current barriers. Overall, the main barriers that prevent adequate financing of an SOE include a weak enabling environment for attracting sustainable ocean finance, insufficient public and private investment in the ocean economy, and the relatively high-risk profile of ocean economic sectors.

To turn these challenges into opportunities, the public and private sectors need to create and better mobilize a full suite of financial tools and approaches, insurance, fiscal and market incentives, and strengthen key aspects of the enabling environment to support the transition to an ocean economy that is sustainable and inclusive by making the benefits it generates available to all, especially, women, youth, and marginalized communities. The most significant action will be to influence future mainstream finance.

By providing clear principles, frameworks, guidance and metrics and proactively avoiding known illegal and harmful activities, substantial amounts of ocean financing would be redirected towards sustainable development pathways, creating long term and positive systemic change. If our recommendation to allocate a higher proportion of ocean GDP to the attainment of an SOE is followed by half of the world’s maritime countries, that alone could generate the seed money needed to incentivize the kind of public and private investments needed to ensure an SOE.

The big message from our article is that a significant increase in sustainable ocean finance will be required to ensure an SOE that benefits all, including a broad section of society and businesses in developing as well as developed countries. In our opinion, the centrality of adequate finance to ensuring an SOE is such that the world may need a Paris Agreement-type effort to meet the needs.

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

U. Rashid Sumaila, Ph.D.

Corresponding author

Fisheries Economics Research Unit

University of British Columbia

Vancouver, BC, Canada

Editor’s note: The original publication has 23 co-authors.