Latin American producers well positioned to satisfy evolving consumer preferences

As various countries in Asia and Latin America continue to produce increasing volumes of tilapia, adding value is an increasingly strategic business approach employed to attract more international customers, penetrate export markets and increase sales.

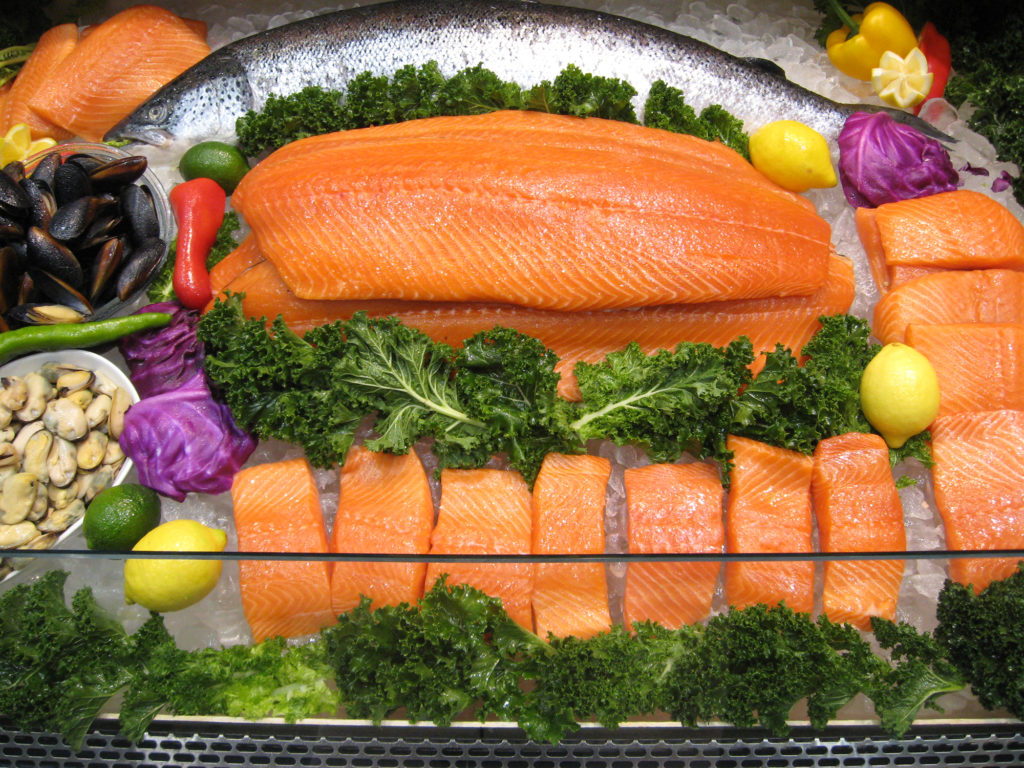

The value-adding trend has recently resulted in varying demand for more traditional seafood products like frozen and fresh-chilled. Value-adding is no longer the niche market it used to be some years ago, and in the case of tilapia fresh fillets – mainly produced in various countries in Latin America – it has become commonplace for the U.S. and other markets.

Value-adding for market penetration

Value-added products are probably the fastest way to penetrate markets, both traditional and new ones. Adding value increases demand and fish consumption in places where land-produced proteins are preferred over seafood products. Some seafood experts believe that the expansion and growth of tilapia markets in the United States and various countries of the European Union will only be possible through high-quality, value-added products, such as fillets in a variety of commercial presentations including different shapes (deep and soft filleting, loins), forms (individual servings, easy-to-cook) and flavors (marinates).

The implementation of well-designed geographic strategies and being aware of consumers’ preferences are ways to reach out to new consumers and expand in places that traditionally have not been exposed to these types of products. And in already-established markets, fillets are becoming more demanding in terms of product appearance, nutritional value, packaging and other characteristics. This has prompted the need to increase the level of investment by members of the production chain, from producers to restaurants chefs and everyone in between.

Fresh fillets perceived as healthier

Fresh fillets are almost always perceived by the consumer as a healthier choice versus the frozen products, the latter being perceived as an “old packed and stored product.” As a result, in most of the producing countries, low labor costs encourage value adding through processing. The geographic advantage (closeness to the U.S. markets) of most producers in Latin America and the rapid advances in quality and reliability of air and land transportation have significantly increased the availability and quality of fresh tilapia fillets available to U.S. consumers.

Some producers can invest large sums of financial and human resources to generate novel value-added products, but one simple way is to improve the presentation and appearance of the fresh fillet itself. One specific producer in Latin America has invested to achieve this goal by cutting the fish in a certain way that makes it more appealing to the eye of the consumer. In fact, this situation has created the basis to strengthen the commercial relationship between this supplier and one the largest supermarket chains in the southern part of the country.

Improved genetics and selective breeding

Improved genetics and selective breeding are a key element to improve fillet quality, in terms of producing fish that yield thicker and wider fillets. If the raw material (whole fish) is not suitable to achieve these goals, markets may not be favorably impacted by the final product (fillet). Some years ago, commercial producers in Latin America adopted various tilapia hybrids with improved phenotypic expressions (fillet thickness) developed in other regions of the world, specifically to thus improve the final appearance of the value-added products. This was the case in Ecuador, Colombia, Honduras and Costa Rica, where the concept of value-added products has developed considering market demands and customer preferences.

Harvest and transport

Proper harvesting and transport to the processing plant are key elements to guarantee the appearance and quality of value-added fillets when they reach markets. One approach used by successful operations to improve these activities involves shortening the transport distances between the production and processing sites. Another way has been to transport the harvested fish – the raw material – live to the processing plant, where it can be depurated if needed, and properly bled. Live transportation is very important to guarantee the freshness of the product when it arrives at the processing facility.

When the processing facility is not located close to the processing plants, harvested fish to be processed for fillets can be placed in a head-to-tail fashion in the carrying boxes so that the fish maintain their straight, original shape and thus prevent the bodies from bending, which can promote “gapping” of the flesh after the harvested fish to be processed go into rigor mortis in a bent shape.

Processing equipment

The use of proper equipment to process value-added products like tilapia fillets must be fully understood by the operators, because otherwise the resulting fillet product might not fulfill market and consumer expectations. Proper training is also essential and the operators must be knowledgeable about the importance of product quality.

Latin American countries that produce tilapia fillets train workers in concepts such as skinning, deep and soft filleting as well as trimming. Specialized labor must cut the posterior ends of the fillet (pin bone), trimming them very delicately, to guarantee the quality required by consumers in the U.S. market and potential consumers elsewhere.

Basic aspects of processing – such as the use of properly sharpened filleting knives – are essential to proper value-adding filleting practices. The angle at which the incision is made to cut the flanks is crucial to optimize fillet yield and avoid holes or punctures that might compromise the appearance of the final product.

Relevance of branding, consolidated relationships

In recent years, many importers and wholesalers of tilapia fillets have consolidated commercial relationships with their suppliers by visiting the processing facilities in the countries of origin. Although this may seem like an intrusion from the processors’ point of view, it has turned out to be a healthy practice that creates synergy among producers and distributors. Consumers also benefit from the improvements generated from the feedback among the different sectors of the production chain.

Finally, branding and fidelity to the brand of a product are essential in the value-added products available in the marketplace. Research to determine product preferences is important to avoid product substitution with a similar item at a similar purchase cost.

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Cesar C. Alceste, M.Sc.

Consultant – Tilapia Production, Processing & Marketing

Miami, FL USA

Tagged With

Related Posts

Intelligence

Adding value to tilapia to tap into U.S. market

New markets for tilapia and expansion of existing ones can be created by planning and implementing properly designed geographic strategies to meet discriminating consumer preferences. Low labor costs in most producing countries promotes value-adding by the production of fresh fillets.

Aquafeeds

Analyzing the hydrostability of shrimp feeds

The physical integrity and nutrient leaching of shrimp aquafeeds are important aspects in their quality control. The water stability of shrimp aquafeeds is often evaluated in various subjective manners. This analytical procedure provides a baseline for the aquafeed manufacturer to assess product quality.

Responsibility

Is purpose the new branding ideal for seafood?

What is the real meaning of corporate social responsibility? How can seafood harness and leverage its virtues? Speakers at Seafood Expo North America concluded that purpose is key to prosperity for an industry that’s central to environmental and human health.

Innovation & Investment

Five critical questions we must answer to grow this industry

Some investors like what they see in aquaculture and its potential to produce wholesome, high-quality food for a growing population. But critical questions must be answered if the industry is to attract the amount of money it needs.